|

Welcome to the second issue of the TRL Insight newsletter!

| If you like what you see here, please subscribe to continue receiving TRL Insight newsletters. Future issues may be distributed using an email delivery service, as described in TRL Insight’s privacy policy. |

Sign up to receive future issues

|

| Please forward this to any colleagues or contacts who you think might find it interesting. |

Given how overloaded with information everyone is these days, this newsletter won’t stick rigidly to a fixed, regular cycle. Instead, it will be issued from time to time, as the content warrants.

This issue focuses on TRL Insight’s outputs since June 2024 and ways that TRL Insight may be able to help you in the future. The recent outputs are covered below under the following headings:

This issue also contains the following:

Please do forward this to any colleagues or contacts who you think might find it interesting.

Local growth

|

|

This February 2025 report highlights the need for predictability in local authority capital finance. It explains what is needed for sufficient certainty to unlock billions of pounds of investment. This includes:

|

|

|

I wrote this article following reports that the Treasury was intending to change the primary measure of public sector debt. Much of it was based on TRL Insight’s 2018 report Building Freedom. It argued that:

|

|

|

Before Autumn 2024 Budget, TRL Insight wrote to Rachel Reeves and Darren Jones.

This letter summarised points in the article described immediately above:

|

Tax yields

|

|

This June 2024 report examines how the Government achieved a strong growth spending on services and goods in the early 2000s. The key to this was increasing tax bases and shrinking bills for other expenditure. Increasing tax rates contributed little and there wasn’t any net borrowing in real terms over the period 1997-98 to 2005-06.

During the 2024 election campaign and since, there has been a narrative that tax rate rises are necessary to fund improvements in public services. By contrast, this study highlights the importance of putting in place conditions conducive to growing tax bases. This, it argues, is the key to implementing spending pledges.

|

|

|

This LinkedIn article accompanies the report described immediately above, Tax Receipts and Government Spending.

This short read challenges the dominant media narrative that the only way to pay for increased public spending is through increasing tax rates.

It points out that the Government can take many actions which will stimulate the growth in tax bases. In the absence of external shocks to the economy, these could provide far higher increases in tax receipts than tinkering with rates. On the other hand, should such shocks occur, the public services will be in a far better shape to weather them.

|

Social care, public health and welfare to work

|

|

This LinkedIn article points out that the biggest problems facing the NHS cannot be fixed by putting money into it.

Rather, they can only be solved by investing further upstream: in public health and in social care – crucially, including respite care.

This short read was in response to an item on the Sky News Daily podcast which contained an interview with a carer.

|

|

|

This LinkedIn article was published to coincide with the Get Britain Working white paper. It discusses how councils have been bringing together services to support people with health issues into work – a policy which was expected to be covered in the white paper.

It also argues that benefit sanctions and Government negativity towards claimants are counter-productive, increasing stress levels and thereby exacerbating health problems.

|

General local government finance

General public finances

How TRL Insight can help you

For a full description of how I can help you, click here.

However, I am most interested in small-scale projects, such as:

- providing expertise and advise in a “senior advisor” role in research work;

- proofreading and “report polishes”;

- quality assurance/auditing spreadsheet analysis;

- providing a short, ad hoc briefing on a subject of interest;

- putting together a small collection of case studies;

- compiling simple spreadsheets from known, high-quality data, for example to feed into a larger piece of analysis;

- carrying out a short, carefully-delineated piece of analysis using robust data such as:

- public sector financial data (expenditure, income, budget figures)

- drivers of such expenditure, for example demographic data, Official Statistics and data collected by local authorities for official purposes.

Three examples of such potential analysis tasks are given below, together with some ideas for and examples of case studies, topics I can speak on and an idea for a roundtable event – hopefully they could provide you with inspiration for work I could do for you.

Further analysis on tax receipts and government spending

|

|

TRL Insight’s Tax Receipts and Government Spending shows how the Government achieved an increase in spending on services & goods from 2000 to 2005 that has not been seen since (see above). This was due largely to growth in the tax bases for the three or four taxes with highest yields and a reduction in other spend.

This analysis could be extended to:

|

Analysis of waste collection costs

|

|

Statistical models designed to explain variations in waste collection costs have often resulted in a poor match to recorded spend.

I could review existing models then carry out analysis to find a model which fits spend data better. This would explore the impacts of variables such as volumes of waste collected, number of households and household size, property types, settlement types (urban, towns, villages, hamlets), and staff wage differentials.

An improved model could help explain your costs to external audiences and predict future costs. For higher cost areas, it could provide evidence for lobbying for improved funding.

|

Drivers of costs and income for your local authority

|

|

I can analyse your authority’s income and spending over an extended period and compare with key drivers of income and costs.

This can help you explain policy decisions to external audiences. By also considering forecasts for demographics and similar data, it can help to provide a sense of the possible future trajectories for these figures.

I have previously carried out similar analysis for collections of local authorities as an associate of LG Futures and LGiU and as an employee of London Councils. More recently (2023-24) I have performed this analysis for a single local authority as part of an APSE Solutions team.

|

Case studies

Speaker slots

|

|

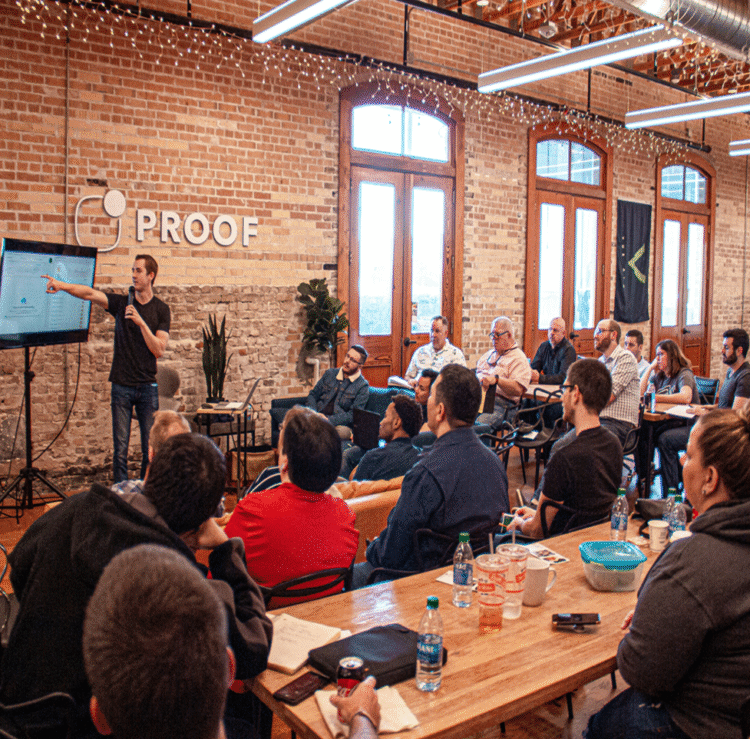

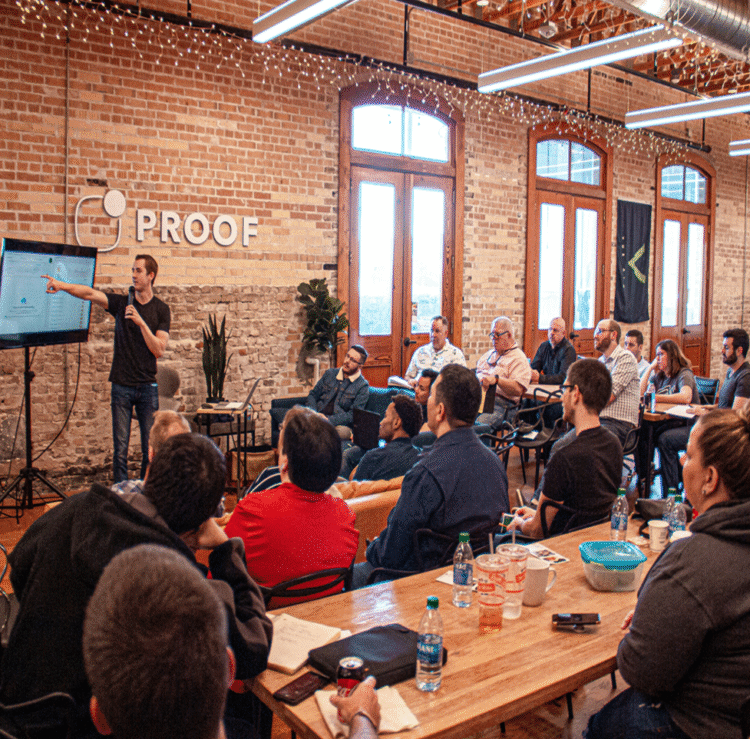

If you are arranging a conference, seminar, webinar, workshop or training session and you’d like me to give a talk or presentation or facilitate a discussion, please get in touch.

My website and the past work described in my last newsletter will give you a sense of the subjects I can speak on. These include:

|

Roundtable event on return on investment

|

|

There are many interventions that public sector bodies can make which require upfront investment, then produce a saving or income return over time. The financial implications of such interventions are being increasingly rigorously analysed.

TRL Insight could play a role in putting together an event which brings together the practitioners of such analysis with representatives of the public sector and bodies that advise and scrutinise it. This could examine the practicalities of a more systematic assessment of such opportunities when budgeting for multi-year periods. |

To discuss further how I can help you, please contact me:

What I’ve been reading and listening to

|

|

This October 2024 report by New Local argues that the way the planning system is currently set up encourages confrontation and controversy. The main way for residents to engage with a planning application is to object.

If, instead, communities are given access to play a more constructive and engaged role, it is possible to build widespread consensus. This can lead to faster and better quality development.

I’d particularly recommend the podcast – and you can listen to it while eating your lunch or doing the washing up! Both the podcast and the report contain inspirational case studies.

|

|

|

This podcast on Local Economic Development is presented by David Marlowe, CEO of Third Life Economics and Mike Spicer, Managing Director of PolicyDepartment. Mike, when working at British Chambers of Commerce, set up the LEP Network, while David spent eight years as CEO of large complex public bodies.

They chat with expert guests on major themes and provide updates on hot topics in local economic development.

I’ve listened to a few episodes and always want to make copious notes on each one!

The podcast is available on Spotify, Amazon Music, Apple Podcasts and Google Podcasts.

|

Mailing options and your data rights

| You can subscribe to future issues of this newsletter or unsubscribe here: |

|

Change my subscription setting

|

| Furthermore, you have a right under the General Data Protection Regulation to know what personal data TRL Insight holds on you, as well as various other rights (including the right to request that that data is amended or deleted), as set out in TRL Insight’s Privacy Policy. If you wish to exercise any of these rights or to know more, contact me here: |

tom@trlinsight.co.uk

|

Images from Unsplash (Suzanne D. Williams: butterfly transformation; HM Treasury: Jagjeet Dhuna; construction: Jacek Dylag; wheelie bins: Pawel Czerwinski; community meeting: Antenna; presentation with audience: Matthew Osborn; data analysis: UX Indonesia; conference room: Sam Szuchan), Pixabay (helicopter: Andy Choinski) and Wikimedia Commons (Leeds Town Hall: Gunnar Larsson)

|

|

|

![]()

![]()